Liechtenstein is known as a financial center in Europe. Through its stable economy, strong public sector and political continuity, the small country offers a good business environment for foreign entrepreneurs.

Table of Contents

What are the types of legal entities I can register in Liechtenstein?

The list below contains the most commonly used types of business entities in Liechtenstein:

- • the public limited company: it is a business form suited to larger corporations and it is a business form that is well-accepted and known internationally;

- • limited liability companies: suitable for small or medium-sized companies, the shareholders are only liable up to the value of the invested capital;

- • the establishments: this is a flexible business form that is unique to the Liechtenstein business environment; it is a form of trust, where the founder gives fiduciary duties to a trustee;

- • the individual enterprise: the equivalent of the sole trader, it is a one-man business in Liechtenstein, suitable for consultants, advisers, and others.

What are the main characteristics of the Liechtenstein legal entity types?

The Liechtenstein public company is formed with a minimum capital of EUR 50.000 divided into bearer or registered shares with a minimum nominal value not stipulated by law. The voting shares are also possible to be issued.

{pyro:startup:start_banner}

The general meeting of the shareholders takes the major decisions in the company and it must be gathered at least once a year to approve the annual account and deal with any other duties stipulated by the articles of incorporation. The board of directors is responsible for daily decisions related to the company.

Besides the above authorities, a Liechtenstein public company must also appoint an audit authority which has to examine the annual account and present it to the general meeting and then deposit it to the Liechtenstein Tax Administration.

The limited liability company is formed by at least one member and has a minimum capital of EUR 10.000 and each shareholder must contribute with at least EUR 50. The capital is divided into preference, registered, voting, and no-par-value and bearer shares.

At least one director is required in order to perform the daily management activities and can be an individual or a corporate. There is no need to appoint secretaries.

Audited annual accounts have to be filed just like in the case of the companies limited by shares. This form of business is designed for small and medium businesses.

The establishment is a specific form of a legal entity registered in Liechtenstein with no members or shareholders and representing an autonomous fund with beneficiaries. It is formed by individuals or corporate bodies which are not the same as the beneficiaries in all the cases. The minimum capital is EUR 30.000 and if higher, at least this amount must be paid up. The management is assured by at least one director. Only if the establishment has commercial objects, the audited annual accounts must be submitted.

The individual enterprise is the simplest business form with no required minimum capital. This is formed by only one individual who is fully liable for the debts and obligations of the business. It is easy to incorporate and has low costs. Moreover, it must only perform mandatory bookkeeping activities if the gross turnover is above 10,000 CHF.

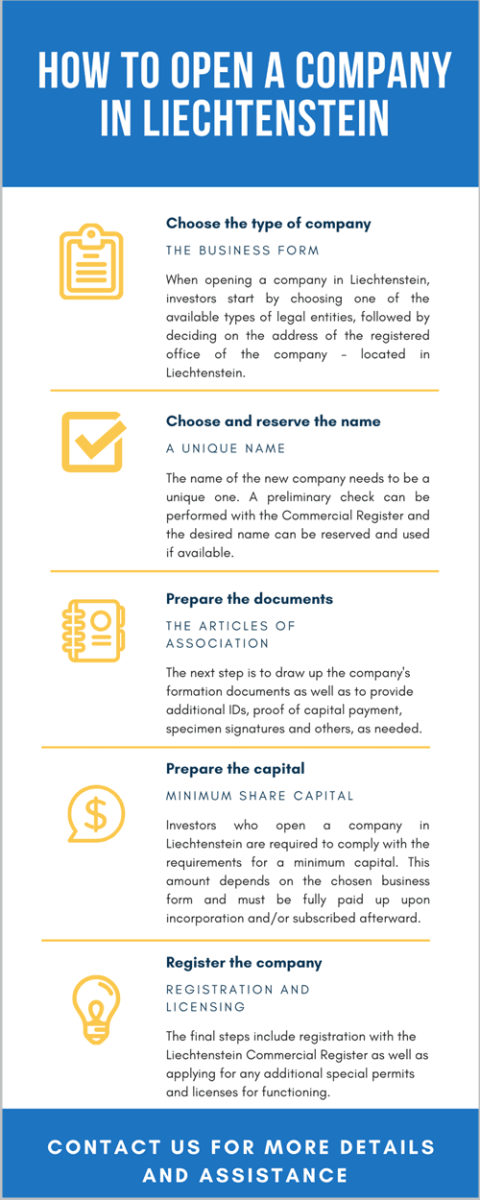

What are the steps for incorporation of a company in Liechtenstein?

The first steps for opening a company are: depositing the minimum share capital in a bank account, checking the name availability in the Public register, drafting and notarizing the articles of incorporation and their deposit at the Liechtenstein Public Registry.

What is the minimum share capital of GMBH and AG in Liechtenstein?

The minimum share capital which has to be submitted by the members of a publiccompany is EUR 50.000, while the minimum share capital of a limited liability company is EUR 30.000.

What documents are required for the incorporation of a company in Liechtenstein?

The following documents and information must be provided to Liechtenstein Public Register in order to have the new entity incorporated:

– the original or certified copy of the articles of association,

– the minute of the meeting where the decision of establishment was taken,

– the acceptance day of the articles of association,

– the name and the registered address of the entity,

– company’s objectives,

– a duration term (if any),

– the amount of share capital,

– details regarding the shares and the payment made by the shareholders,

– details regarding the members of the board and the representatives.

How are companies taxed in Liechtenstein?

Resident companies are taxed on their worldwide profits. The standard corporate income tax rate is 12.5 percent and an alternative minimum tax applies for small companies. This alternative tax has a standard value of 1,800 CHF. Other taxes for companies include the withholding tax, the payroll tax, the stamp duty, and social security contributions. As far as the value-added tax is concerned, Liechtenstein is considered part of Switzerland for the purpose of implementing this specific tax. The standard VAT rate is 7.7% and certain goods and services are taxed at two reduced rates of 3.7% (for hotels and businesses in the lodging industry in general) and 2.5% (for banking services and others).

The accounting requirements for companies in Liechtenstein include an annual submission of the tax return before July 2st the following year. Tax payments have a due date on August 31st the following tax year. Companies are subject to penalties for late filing or for failure to comply with the filing regulations.

Do companies need special permits in Liechtenstein?

Yes. Selected business fields are under special regulations and will require additional permits and licenses. Regardless of their chosen business fields, companies in Liechtenstein must obtain a business permit before commencing their commercial activities.

Companies engaged in tradign activities will need special permits and licenses and will need to be registered for EORI purposes for customs procedures.

We invite you to watch a video about opening a company in Liechtenstein:

Why should investors choose to open a company in Liechtenstein?

Liechtenstein is a small country but its position at the heart of Europe can offer indisputable advantages to investors who wish to set up their headquarters in Europe. Its corporate law is conceived so as to offer a convenient degree of flexibility and a reasonably straightforward and simple company formation procedure, even for foreign entrepreneurs. Some of the location advantages are included in the list below:

– good location

– economic and political stability

– good connectivity

– minimal corporate requirements (one director and one shareholder needed to open the company)

– access to local employees who are skilled

– a financial center in Europe

How can our lawyers help you?

Our team of lawyers in Liechtenstein can help you throughout the company formation process. We can assist with drafting the Memorandum and Articles of Association and through a power of attorney, we can make the necessary submissions for corporate registration and for obtaining the necessary permits and licenses.

Together with our team of lawyers, you will be able to handle any employment and taxation issues that may arise during the performance of the business activities. We can help conclude employment contracts, handle dismissal issues, draft business contracts as needed consult in the Intellectual Property Law. Moreover, our experienced team of lawyers can represent you in court or in case of arbitration. Our extensive experience with international clients also recommends us in case of international dispute resolution.

We can help you start and manage a business in Liechtenstein. For more details about registering a company, you may contact our lawyers in Liechtenstein.