Liechtenstein is an attractive location for assets investments. By the recent amendments to the Tax Law, ratified in 2011, Liechtenstein truly modernized its taxation system. With one of the most competitive legal frameworks, Liechtenstein has become an interesting spot for both local investors and international ones. However taxation rates could quite often be subject to changes, thus we advise you to regularly consult with attorneys in Liechtenstein for up to date information.

Table of Contents

Taxation rules in Liechtenstein

Only if you are a tax resident in Liechtenstein, you will be taxed on your worldwide income. For non-residents, the taxation applies only for the revenue generated in Liechtenstein. In case a commercial activity takes place at large in the European Union, there is a risk of double taxation. In order to avoid such thing, it is advisable for the owner to contact a law firm in Liechtenstein and to have this issue clarified.

Both on-shore and off-shore legal entities, regardless whether commercially run or non-commercial businesses, will respect the same taxation rules. There is a flat tax rate of 12.5% applied to the company’s net profit, and an amount of 1,200 Swiss francs as a minimum corporate tax payable by legal persons such as private asset structures (PVSs).

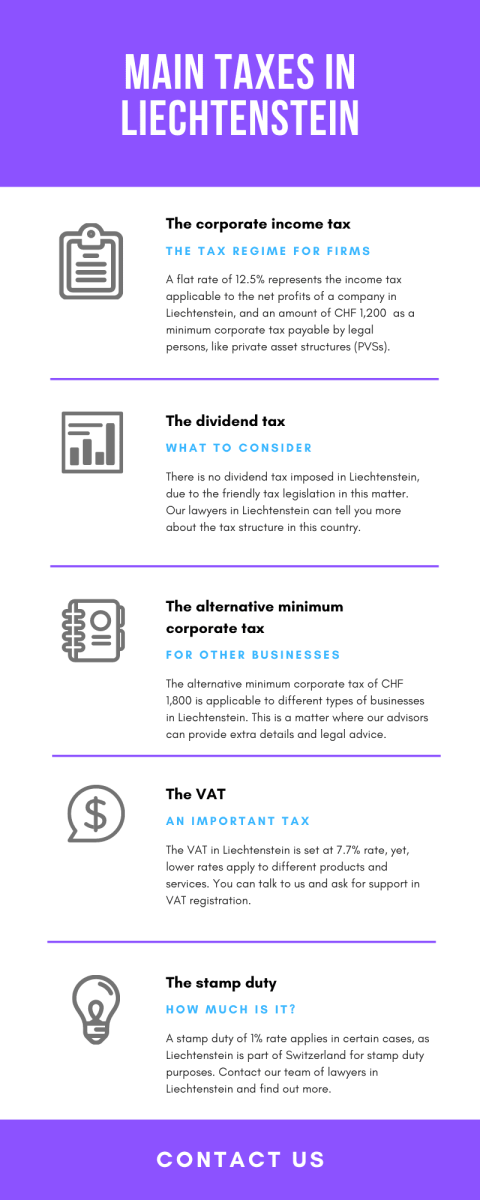

The income subject to taxation is the total revenue of the company, from which one can subtract well motivated business expenditures. For legal advice regarding taxation in Liechtenstein you could employ the services of a law firm in Liechtenstein. Here is an infographic with extra details:

Tax Law innovations in Liechtenstein

There are several elements of modernization which have been adopted in the Liechtenstein Tax Act from 2011:

- the inclusion of group taxation – one of the principal new elements introduced by the 2011 Law is the strategy of corporate association, targeting a better compensation of eventual losses over the year;

- provisions regarding the taxation of patent income;

- regulations on the taxation of insurance premiums;

- the provision on branches – they follow the general taxation rules which apply to all companies in Liechtenstein;

- taxation issues regarding cross-border restructurings;

- the annulment of special company taxes for domiciliary companies (companies with a registered office in Liechtenstein, but managed and controlled from abroad).

Is there a dividend tax in Liechtenstein?

Liechtenstein provides a friendly legislation to the beneficiaries of dividend payments. Regardless of whether the dividend income proceeds from foreign or local investment, the state does not impose a tax on it.

Liechtenstein does not impose a withholding tax on dividends. However, anti-avoidance rules do apply and according to these, dividend income from investments in foreign companies is not tax-exempt from income tax is more than half of the total income of that foreign company is composed of passive income and the company is subject to low taxation. This rule applies starting with 2019 for participations established in 2019 and it will apply starting with 2022 for participations established before 2019. Investors who need more information about the new regime for dividend taxation can reach out to the team at our law firm in Liechtenstein.

Dividends received from capital gains and participations from the sale of qualifying participations are exempt from tax, however, these can also be subject to anti-avoidance rules. As of 2019, the depreciations on participations and capital losses will not decrease the tax base.

Our team of tax lawyers in Liechtenstein can provide investors with complete details about the transactions for which companies are expected to pay taxes.

Are dividend withholding taxes imposed in certain cases?

The Tax Cooperation Agreement between Liechtenstein and Austria, which entered into force in 2013, includes a provision according to which Liechtenstein paying agents, such as banks, are to withhold tax on dividends and the value is 27.5% when these dividends (and capital gains) are paid to a trust, foundation or another type of establishment that is transparent for taxation purposes. The beneficial owner of the entity receiving the payment is an Austrian resident in this case. An exemption applies when the banking secrecy is waived and the bank may instruct the Austrian Tax Authority on the dividend payment.

The capital gains which result from the sale of an equity participation (ownership of shares in a company) are also exempt from taxation, according to the Liechtenstein law. However, capital gains can be subject to tax if the dividend distributions from the concerning company were not subject to tax exemption. There is no withholding tax on royalties or on property rental payments made to non-residents.

If you need more information about the dividend tax in Liechtenstein, our attorneys in Liechtenstein can offer you all the relevant details for your business.

What are the taxes applicable to companies in Liechtenstein?

As a member of the EEA Agreement, investors in Liechtenstein benefit as well from advantageous taxation regulations when extending their trade activity to other economic areas included in the agreement. Moreover, the double taxation conventions signed between Liechtenstein and other countries provide to investors the possibility of tax deduction at source on dividends.

The list below includes the main taxes for companies in Liechtenstein. When needed, our team of tax attorneys in Liechtenstein can provide more details.

- Corporate income tax: 12.5%.

- Minimum tax: 1,800 CHF is the alternative minimum corporate tax that can apply to certain businesses.

- Tax on remuneration paid to members of the Board of Directors of Liechtenstein companies: 12%; when the remuneration is above a certain amount, it is subject to unrestricted tax liability.

- Employee costs: the employer will pay a little more than 50% of the social security and pension fund contributions per employee.

- Stamp duty: Liechtenstein is part of Switzerland for stamp duty purposes; a stamp duty of 1% applies in certain cases.

- VAT: the standard rate is 7.7% with certain goods and services taxed at a reduced rate of 2.5%; banking services and others are exempt and the hotel and lodging industry is subject to a 3.7% rate.

Taxation compliance for companies in Liechtenstein

Companies are expected to observe the applicable tax rates listed above and in addition to this comply with the filing requirements. The tax return is to be filed by 1st July the year following the year for which the assessment was made. The tax payment is due within 30 days following the receipt of the assessment. Companies are not required to submit estimated payments for the corporate income tax. One exception can take place when the company has chosen to extent the filing date beyond the usual deadline. In this case, the taxpayer will provide a provisional invoice that is based on the last assessment. One of our attorneys in Liechtenstein can offer more details about these due dates.

Penalties apply for late filing or failure to comply with the filing requirements. Investors can avoid these by reaching out to our team of lawyers in Liechtenstein.

Liechtenstein has signed nineteen double tax treaties with various countries among which Andorra, Austria, Bahrain Germany, Hong Kong, Luxembourg, Singapore, Switzerland or the United Kingdom. Negotiations are ongoing with other jurisdictions as part of an effort to expand the treaty network. All of the treaties for the avoidance of double taxation follow the OECD model. The treaties signed to date do not contain clauses for the limitation on benefits. Liechtenstein does follow the OECD minimum standards for base erosion and profit shifting which refer, among others, to hybrid arrangements or the exchange of tax rulings. One of our lawyers in Liechtenstein can provide foreign investors with detailed information about the manner in which these treaties apply.

The attractive taxation conditions provided by the government of Liechtenstein, including the exemption from taxation of dividend income, is making this country a good choice for investment.

Tax minimization for companies in Liechtenstein

The taxation system in the Principality comes with numerous benefits for both businesses and residents. A proper tax planning in Liechtenstein is the suitable tax minimization method which involves the monetary conveniences provided by authorities in charge, in order to reduce the taxes imposed on companies and individuals in the country.

The 12.5% corporate tax rate is already considered a valuable tax minimization solution for foreign enterprises with permanent establishments in Liechtenstein. Besides that, the Principality has signed numerous double tax agreements with countries worldwide and foreign companies registered in Liechtenstein can benefit from a 2.5% tax rate on dividend payments and no other fees on royalties and interests. Additional information in this matter can be offered by our attorneys in Liechtenstein who can offer legal advice when opening a business here.

Tax minimization for natural persons in Liechtenstein

It is good to know that the residents in Liechtenstein can deduct the employment costs related to the commuting, living, education, and healthcare, which are considered a suitable tax minimization opportunity for local or foreign employees. Moreover, any gifts or bonuses are not subject to taxation. As for the real estate acquirements, individuals in Liechtenstein will not pay any taxes in this matter.

Taxes paid by foreign companies in Liechtenstein

The main taxes applied to foreign companies in Liechtenstein are the following:

- corporate tax – The net profit of a company in Liechtenstein is taxed at a flat rate of 12.5%. There is also a minimum amount of 1,200 Swiss francs which is applied to companies with moderate annual revenue. Even non-resident companies who obtain income from Liechtenstein are obliged to pay the full tax amount for the entire tax period. An exception is applied to companies whose revenues do not exceed CHF 500,000 for a period of three years.

- value added tax (VAT) – The general VAT rate in Liechtenstein amounts to 8%, which is one of the lowest rates in the European space. Exemptions apply to enterprises which gain profits from sectors such as health, education and insurance. Our Liechtenstein lawyers can tell you more about the special rates which apply to particular industries in this country.

- related to social insurance (PRSI) – There are several insurance pillars in Liechtenstein which receive payments from employers. These refer to contributions to several funds, such as the old age and survivors’ insurance (AHV), disability insurance (IV), family allowances fund (FAK), unemployment insurance (ALV) which amounts to no more than 6% of the salary.

You can confidently rely on the advice of our attorneys in Liechtenstein for tax planning services in this country.

Special taxation conditions for foreign investors in Liechtenstein

There are several ways in which foreign investors in Liechtenstein benefit from special tax conditions. Foreign tax relief is allowed against domestic taxes through the credit method, according to the double taxation treaties signed by Liechtenstein with other economies.

Another aspect which regards the taxation of foreign investors is the Liechtenstein regulation regarding the dividend payments. The state does not impose a tax on the income which proceeds from foreign investment.

For more information on taxation and for a professional counseling in these issues, don’t hesitate to contact our lawyers in Liechtenstein.